Formula for achieving financial success often eludes many, but it can be simpler than you think. By implementing the right strategies and mindset, you can transform your financial landscape. In this post, you will discover powerful techniques designed to attract abundance and prosperity into your life. From cultivating a wealth-oriented mindset to strategic planning, these insights will guide you on your journey to becoming a money magnet. Get ready to unlock the doors to financial freedom and abundance.

Understanding the Money Magnet Concept

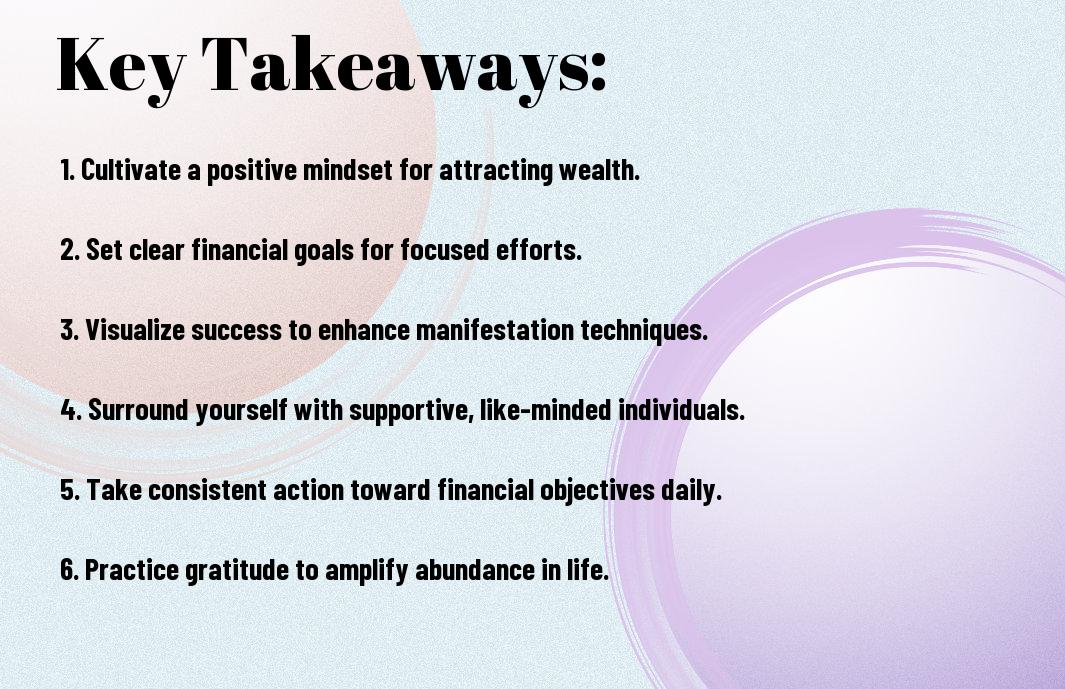

Your journey to financial success starts with grasping the Money Magnet concept. This principle suggests that your mindset and beliefs about wealth play a significant role in attracting financial opportunities. By aligning your thoughts and actions with your financial goals, you can create a powerful magnetic force that draws abundance into your life. Embracing this concept empowers you to change how you perceive and interact with money, setting the stage for prosperity.

The Psychology of Wealth Attraction

Magnetizing wealth begins with understanding the psychology behind wealth attraction. It involves building a mindset that accepts the possibility of financial abundance, fostering positive beliefs about your ability to attain it. This shift in perception allows you to recognize opportunities, overcome challenges, and develop a healthy relationship with money, ultimately enhancing your ability to attract it effortlessly.

Shifting Mindsets for Financial Success

At the heart of financial success lies a willingness to shift your mindset. This involves letting go of limiting beliefs and replacing them with empowering affirmations that support your goals. By focusing on growth rather than scarcity, you open yourself up to new possibilities and experiences that can lead to wealth accumulation and financial stability.

Financial transformation begins with the understanding that your thoughts and beliefs shape your reality. Embracing a growth-oriented mindset enables you to identify and seize wealth-building opportunities. When you actively cultivate a positive outlook on money and its potential, you initiate a ripple effect that attracts successful outcomes. This proactive approach not only enhances your financial situation but also instills a sense of confidence and resilience in navigating your financial path.

The Formula for Financial Success

One of the key elements to achieving financial success lies in understanding and implementing a clear formula that aligns your financial goals with actionable steps. This formula combines strategic planning, goal setting, and consistent evaluation of your progress, empowering you to attract wealth effectively. By following this structured approach, you elevate your potential for financial achievement and open the door to opportunities that align with your unique aspirations.

Defining Goals and Aspirations

With clarity in defining what you truly desire, you lay the groundwork for your financial journey. Setting specific, measurable, achievable, relevant, and time-bound (SMART) goals enables you to focus your efforts on what matters most. By recognizing your aspirations, you create a roadmap that steers your financial decisions and actions toward fulfilling your personal vision of success.

Creating a Strategic Action Plan

Any successful financial journey begins with a well-structured action plan that outlines the steps necessary to reach your goals. Your strategic plan should include timelines, resources, and measurable milestones to keep you accountable as you navigate your financial path. This blueprint will serve as your guide, allowing you to monitor progress and make adjustments as needed to stay on course.

In fact, developing a strategic action plan requires careful consideration of the resources you have at your disposal, including your skills, knowledge, and financial capacity. Break your main goals down into smaller, manageable tasks that you can tackle on a daily or weekly basis. By prioritizing these tasks and setting deadlines, you enhance your productivity and maintain momentum towards achieving your financial aspirations. Regularly review and refine your plan to adapt to any changes in your circumstances or objectives, ensuring you remain aligned with your ultimate vision of success.

Building a Wealthy Mindset

After understanding the importance of financial success, it’s necessary to shift your mindset to attract wealth. A wealthy mindset empowers you to recognize opportunities, embrace challenges, and stay motivated toward your financial goals. By changing the way you think about money and success, you can unlock the potential within yourself to create lasting financial abundance.

Overcoming Limiting Beliefs

Limiting beliefs often act as barriers to your financial success, making you question your abilities and worth. Identifying these beliefs is the first step in breaking free from them. Challenge negativity by reframing your thoughts and reinforcing a mindset that believes in your potential to attract wealth, allowing you to move forward with confidence.

Cultivating Gratitude and Abundance

Abundance begins with acknowledging what you already have, fostering a mindset rich in gratitude. By appreciating your current resources, you set the stage for attracting more prosperity into your life. When you focus on gratitude, you shift your energy towards positivity, naturally inviting in greater wealth and opportunities.

Even small expressions of gratitude can amplify your sense of abundance and enhance your ability to attract more financial success. Start a daily gratitude practice, writing down things you appreciate about your current situation. This simple act rewires your mindset, helping you recognize the wealth around you and opening your heart to recognize and accept even greater opportunities and gains.

Effective Networking and Relationships

To unlock financial success, you must embrace the power of effective networking and relationships. Building a solid network connects you to opportunities, resources, and guidance that can significantly enhance your journey towards financial stability. Strategic collaboration and relationship-building lead to valuable insights and partnerships that can elevate your financial endeavors.

The Importance of Connections

Behind every successful individual lies a robust network of contacts that opens doors to possibilities. Your connections provide support, guidance, and opportunities, allowing you to tap into shared experiences and resources. Nurturing these relationships enables you to navigate challenges more effectively and discover new avenues for growth.

Leveraging Community Resources

Above all, your community is a treasure trove of resources that can enhance your financial journey. Engaging with local organizations, workshops, and events allows you to gain knowledge and access to tools that facilitate financial growth. By actively participating in community initiatives, you can forge connections that lead to collaborative opportunities.

Networking with local resources helps you stay informed about workshops, seminars, and community initiatives that can support your financial goals. Consider attending meetups or joining local business groups where you can connect with like-minded individuals. These interactions not only expand your knowledge but also create a foundation of support, where you can collaborate and share ideas that propel you towards financial success. Your community can serve as a catalyst, providing the motivation and resources you need to thrive.

Investment Strategies for Growth

All successful financial journeys begin with effective investment strategies aimed at achieving growth. By understanding various investment avenues and adhering to sound principles, you can maximize your potential returns. It’s important to consider factors such as market trends, asset classes, and tax implications to build a robust wealth-generating strategy that aligns with your financial goals.

Diversifying Your Portfolio

Above all, diversifying your portfolio is necessary for mitigating risk and enhancing returns. By spreading your investments across various asset classes—such as stocks, bonds, and real estate—you can reduce the impact of market volatility on your overall financial picture. This strategy allows you to benefit from different market conditions while safeguarding your wealth over time.

Understanding Risk Management

Growth in your investment portfolio requires a clear understanding of risk management. By assessing the potential risks associated with different investments, you can make informed choices that align with your comfort level. Balancing high-risk and low-risk assets helps preserve your capital while enabling you to pursue higher returns.

The key to effective risk management lies in recognizing that all investments come with inherent risks. You should regularly evaluate your risk tolerance and adjust your investment strategy accordingly. Implementing stop-loss orders, conducting thorough research, and staying informed about market changes are necessary practices that empower you to navigate the complexities of investing, minimizing potential losses while maximizing your growth opportunities.

Maintaining Continued Success

Keep your financial momentum going by establishing solid habits that promote growth and stability. Regularly assess your strategies and remain adaptable to changing circumstances. Consistency in your approach will help you build on your past achievements and pave the way for long-term prosperity. Making incremental improvements will empower you to navigate the complexities of financial success with confidence.

Monitoring Progress and Adjustments

With continuous monitoring of your financial goals and progress, you can identify patterns that require adjustment. Evaluate the effectiveness of your strategies on a regular basis and be willing to change course when necessary. Adaptability in your financial planning allows you to seize new opportunities and mitigate potential setbacks, ensuring that you stay aligned with your aspirations.

The Power of Lifelong Learning

Across various fields, knowledge is a key differentiator for achieving financial success. Embracing a mindset of lifelong learning enables you to stay ahead of the curve and adapt to evolving trends in the marketplace. You should seek to acquire new skills, attend seminars, and read extensively to enhance your expertise. Staying informed empowers you to make educated decisions and opens up fresh avenues for growth.

Another vital aspect of lifelong learning is the ability to learn from your experiences, both successes and failures. By analyzing what worked and what didn’t, you can refine your approach and make informed adjustments moving forward. Engage with mentors and industry leaders, as their insights can provide valuable guidance on your journey. This commitment to continuous self-improvement will not only bolster your financial knowledge but also reinforce your resilience in an ever-changing economic landscape.

Conclusion

As a reminder, mastering ‘The Secret Money Magnet Formula’ empowers you to unlock financial success by transforming your mindset and habits. By embracing the principles outlined in this guide, you can attract wealth and create opportunities that align with your financial goals. Your journey towards abundance begins with you taking actionable steps and believing in your potential, ensuring that you not only achieve but sustain financial prosperity in your life.

Leave a Reply